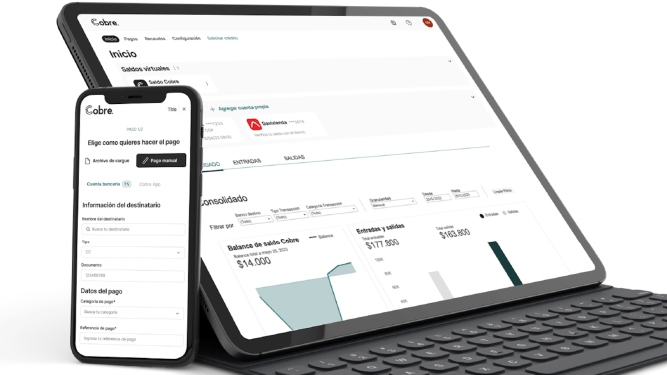

If you don’t know your company’s financial status, it is difficult to make decisions for the betterment of the company. This is where Cobre comes in. The Colombia-based startup developed a corporate treasury platform to give chief financial officers more visibility and control over their company’s financial transactions, specifically, to centralize, digitize and automate their payment processes.

Cobre’s Two-Pronged Approach

Cobre’s is a two-pronged approach: First is the enterprise software that centralizes payment initiation and reconciliation for finance teams across the region. Second is the payment rails — built by the company itself — that allow for PIX-like instant payments and real-time data. All of that is accessible via API and compatible with any bank in Colombia, Jose Vicente Gedeon told TechCrunch via email.

‘[Building our own payment rails] is a long-game approach that takes time but delivers the best, most direct and most customizable experience for clients,’ Gedeon said. ‘It has allowed us to act as a universal translator for each bank, ERP (enterprise resource planning) and company. That way, we can skip the unnecessary intermediation that is typical of payments and truly open the financial systems for our clients.’

The Right Treasury Management Strategy Can Extend Your Startup’s Runway

Company growth requires making informed decisions about financial transactions. With Cobre’s platform, CFOs can streamline their operations and make better decisions to extend their startup’s runway.

Gedeon started the company with his cousin, Felipe Gedeon, Jose Donato and Alberto Chejne in 2020. The team comes from various backgrounds, with Jose beginning at McKinsey before going over to hospitality company Oyo. Felipe also worked in hospitality, leading growth strategy for Selina. Meanwhile, Donato worked in software development roles at Banco de Bogota and Modyo, while Chejne held a role in enterprise software and client success at SAP.

Three Years of Growth

Three years later, Cobre is helping hundreds of CFOs, primarily in financial services and large enterprises, across Colombia streamline their operations. Cobre’s plan from the beginning was to start with large corporations, with the idea that those clients would be able to afford the infrastructure the company has to build, Gedeon said.

Expansion into New Customer Segments and Geographies

Now it is slowly expanding its customer base into new segments and geographies. The company’s growth can be attributed to its innovative approach to treasury management and its ability to adapt to changing market conditions.

Cobre’s Impact on the Financial Industry

Cobre’s platform has had a significant impact on the financial industry in Latin America. Its innovative approach to treasury management has allowed companies to streamline their operations, reduce costs, and improve their bottom line.

The Future of Treasury Management

As the financial landscape continues to evolve, Cobre is well-positioned to continue its growth trajectory. The company’s commitment to innovation and customer satisfaction will enable it to stay ahead of the competition and remain a leader in the treasury management market.

Conclusion

Cobre’s success story is a testament to the power of innovation and hard work. The company’s dedication to providing a high-quality platform that meets the needs of its customers has allowed it to achieve significant growth and establish itself as a leader in the treasury management market. As the financial industry continues to evolve, Cobre will remain at the forefront, driving change and shaping the future of treasury management.