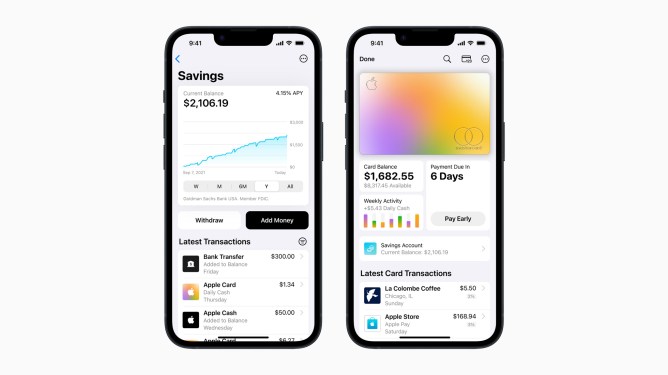

Apple has announced that its high-yield Savings account, offered by Goldman Sachs as part of the Apple Card financial product, has surpassed a milestone of over $10 billion in deposits from users since its launch in April. This achievement is a testament to the popularity and appeal of the Savings account, which offers an attractive APY (annual percentage yield) of 4.15%.

Key Features and Benefits

The Savings account, like other Apple Card features, is designed with the user’s financial health in mind. Some key benefits include:

- Daily Cash: When customers pay with their Apple Card, they receive cash back on all purchases. By default, all purchases grant 1% in cash rewards, while purchases made using Apple Pay earn 2%. Additionally, select merchants offer a 3% reward rate.

- Automatic Deposits: Since launch, an impressive 97% of Savings customers have chosen to have their Daily Cash automatically deposited into their account.

- No Limit on Earnings: There is no limit on how much Daily Cash users can earn.

- Easy Fund Management: Users can deposit additional funds into their Savings account through a linked bank account or from their Apple Cash balance.

Security and Regulation

The Savings accounts are technically managed by Goldman Sachs, which means that balances are covered by the Federal Deposit Insurance Corporation (FDIC). This provides an added layer of security for users’ deposits.

User Adoption and Feedback

Apple’s Vice President of Apple Pay and Apple Wallet, Jennifer Bailey, emphasized the company’s commitment to reinventing financial categories with user financial health in mind. "With no fees, no minimum deposits, and no minimum balance requirements, Savings provides an easy way for users to save money every day," she said.

Goldman Sachs’ Head of Enterprise Partnerships, Liz Martin, also expressed satisfaction with the success of the Savings account, highlighting Apple’s focus on creating a best-in-class customer experience that helps consumers lead healthier financial lives.

Getting Started with Apple Card Savings

Users can set up and manage their Savings account directly from the Wallet app. To get started:

- Access Apple Card from the Wallet app.

- Tap "More" and select "Daily Cash."

- Tap "Set Up Savings" and follow the onscreen instructions.

Once set up, users will have access to a Savings dashboard in the Wallet app where they can track their account balance and interest earned over time.

About Apple Card and Goldman Sachs

Apple Card is a financial product offered by Apple in collaboration with Goldman Sachs. The Savings account, launched as part of this partnership, offers an attractive interest rate and convenient management features, making it an appealing option for users looking to save money.

The success of the Savings account is a testament to Apple’s commitment to providing innovative financial products that prioritize user financial health.